National debt explosion: The Fiscal Time Bomb and its Implications

US national debt has reached $35trn. Interest payments now exceed military spending and other secret service budgets combined. What are the implications?

Zürich, 24 September 2024. National debt has reached a new all-time high of $35 trillion, and counting. If you read this note a few weeks after I wrote it, the chances are the US will already have reached $ 36 trillion in national debt. Just check the debt clock. But make sure you sit down before you open this link, or else you might get dizzy – or weak in the knees.

Of course it is the largest absolute amount of national debt in the world, and in world history in real terms.

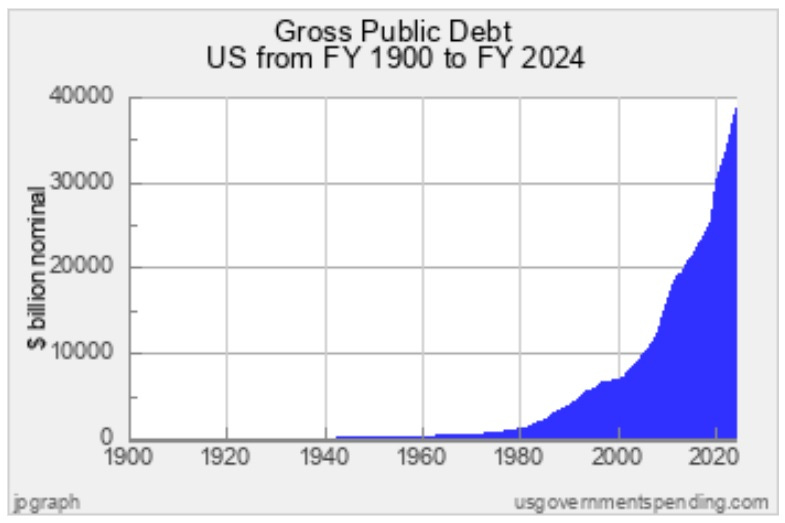

The exponential accumulation of debt in recent years becomes especially obvious when we consider the long-term historical perspective as shown in this graph:

Since this US debt mostly takes the form of Treasury bonds issued with fixed promises to pay interest, the annual servicing cost of this national debt has now also reached historic proportions.

Interest payments on debt now exceed $ 1 trillion, ahead of military spending

According to the September 2024 US Treasury Bulletin, the U.S. government has spent over $1 trillion on interest payments for its nearly $35 trillion national debt so for this fiscal year, according to the Treasury Department. This is a new historical record.

Looking at the breakdown provided the September Bulletin published by the Treasury, which actually refer to the figures as at the end of June 2024, the gross interest on Treasury debt securities rose to $868 billion. We need to add interest payments on other obligations of $177 billion, giving us the world record high in interest payments of $1.045 trillion.

Given total fiscal expenditure of $5,027 billion, and total revenues from taxes, social security contributions and other sources amounting to only $3,754 billion, the deficit in the fiscal year to date by the end of June amounted to $1,273 billion. So gross interest payments of $1.045 trillion constitute 21%, more than one fifth of the total US government expenditure so far this year. At the same time, the interest payments amount to 82% of the US government budget deficit so far this year. This marks a 33% increase of gross interest payments by the government, compared to the same time in the previous year.

Since we have to add the significant budget deficits of July and August to these June data, with the August budget deficit alone surging to $380 billion, it seems highly likely that the 2024 US government budget deficit will exceed $2 trillion. The government’s official estimate of June 2024 that the deficit will come in at $1.9 trillion is likely to be overtaken by events, just as its debt forecast that national debt would only reach $35 trillion by the end of 2024 already has.

So where is all the US government expenditure going?

Subtracting government investment earnings, we obtain net interest payments, which still amount to more than $800 billion, ranking just below Social Security and Medicare, and ahead of the spending by the Department of Defense, which used $608.6 billion. Even adding up the Deep State/military-complex departments of “Defense”, “Homeland Security”, “State Department”, “NASA” and “Independent Agencies” (including several of the 17 secret service agencies), the total comes in at $ 794.6 billion, still behind the government spending on interest payments.

Interest payments have jumped by 30 per cent over the same period last year. 2024 is indeed the first year in the history of the United States of America that payments to receivers of coupons on the government debt have exceeded expenditure on the military (US military spending being by far the largest in world, ca. nine times larger than Russian military spending).

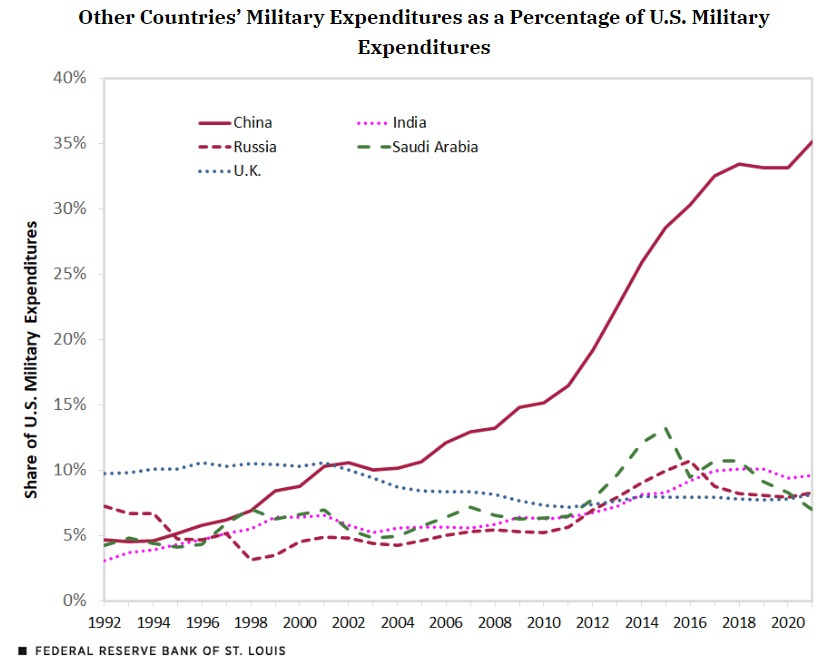

A publication by the Federal Reserve Bank of St. Louis knows how to present the massive military spending by the United States: The chart of the international comparison simply gives the US a different scale, alone among all countries whose expenditure is shown. This hides the fact that the US has by a long distance the largest military spending in the whole world.

Spot the presentation trick

Servicing the national debt via interest payments is well on track to soon becoming the single most dominant share of Washington’s budget. Governments often like to hide the interest payments when they present their spending, by restricting the displayed information to “non-discretionary spending”, which conveniently excludes interest payments. Remember, we are no dealing with governments that believe merely “explaining” things properly to us, ideally using behavioural psychology (i.e. mind manipulation) and propaganda, in order to feed us the one and only truth, while any critics by definition utter “misinformation” or “disinformation” that is rapidly being outlawed in Europe, Australia and perhaps even the US.

Elon Musk: America is going bankrupt extremely quickly (9 September 2024)

On 9 September, Elon Musk expressed deep concern about the acceleration in the accumulation of national debt in the US and the fact that interest payments alone now exceed military spending. He also noticed that it now only takes ca. 3 months to add another one trillion dollars to national debt.

“America is going bankrupt extremely quickly. …Interest payments on national debt just exceeded the Defense Department budget, but they’re over a trillion dollars a year. Just in interest. And rising. We’re adding a trillion dollars to our debt, which our kids and grandkids will have to repay somehow, every three months. And then soon it’s going to be two months, and then every month… And then the only thing we will be able to pay is interest… This is not a good ending.”

Already in January this year Elon Musk had stated: “I am alarmed by the US debt”. It stood at $ 34 trn then. On 3 May this year he stated:

“We need to do something about our national debt or the dollar will be worth nothing.”

Keep reading with a 7-day free trial

Subscribe to Richard Werner’s Substack to keep reading this post and get 7 days of free access to the full post archives.