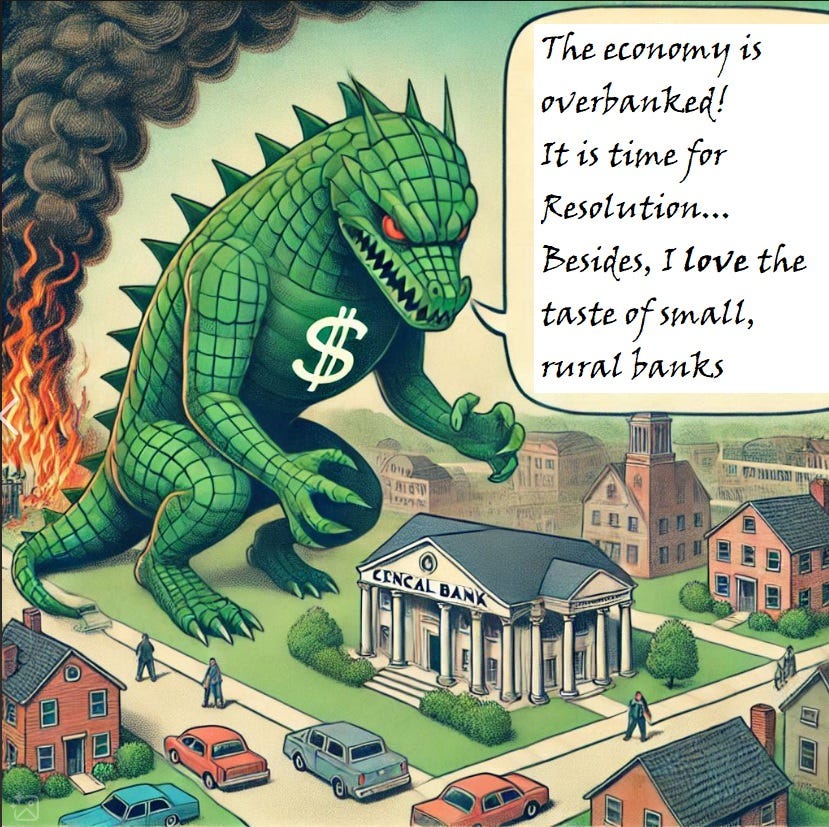

Debunking anti-bank propaganda

The regulators’ attack on small banks is part of the war on the middle class

London, 8 December 2024. Since Autumn 2022, when central banks did the inevitable and predictable, namely raising interest rates, numerous commentators have been warning us of an imminent US banking crisis. True, the size of the interest rate rise, within such a short time period, was unusual (500 basis points within one and a half years). But it was entirely predictable and not surprising at all that rates were going to rise significantly, since empirical research has long established that interest rates follow economic growth and are positively correlated with it. The dramatic QE2 policies by the Federal Reserve of March 2020 had to boost nominal GDP growth sharply in late 2021 (it usually takes 12 to 18 months).

QE2 is the second part of my original Quantitative Easing proposal I had developed in the 1990s for a Japanese economy in the grips of deflation and suffering from contracting nominal GDP growth. It works by enabling the central bank to enforce a massive expansion in bank credit creation, ballooning the money supply, by the central bank purchasing assets from non-banks. This is what the Fed did in March 2020, when, having hired Blackrock for the purpose, it purchased assets from the non-bank sector at unprecedented scale. This meant that nominal GDP growth was accelerated sharply, mainly due to the significant inflation that I warned would be caused by the March 2020 central bank policies (with a delay of 18 months after March 2020). Since rates follow nominal GDP growth, they had to surge as well. The Fed tried hard to delay it. But ultimately cannot prevent major rate movements. So it relented in late 2022.

By March 2023, two banks were shut down, Silicon Valley Bank, the biggest, and Signature Bank, New York. Both had been active in the crypto space. In April 2023, First Republic Bank in San Fransisco was shut. Since then, another four banks have been closed, most recently First National Bank of Lindsay, Oklahoma, in late October 2024.

Hence the persistent talk about a banking crisis in the US, with further trouble brewing, we are being warned.

Source: American Banker

Central banks have been working hard against the many small banks

Why the talk of a banking crisis? Before we come to this, let’s be clear about the

Keep reading with a 7-day free trial

Subscribe to Richard Werner’s Substack to keep reading this post and get 7 days of free access to the full post archives.